25+ mortgage interest limits

Homeowners who bought houses before. Estimate your monthly mortgage payment.

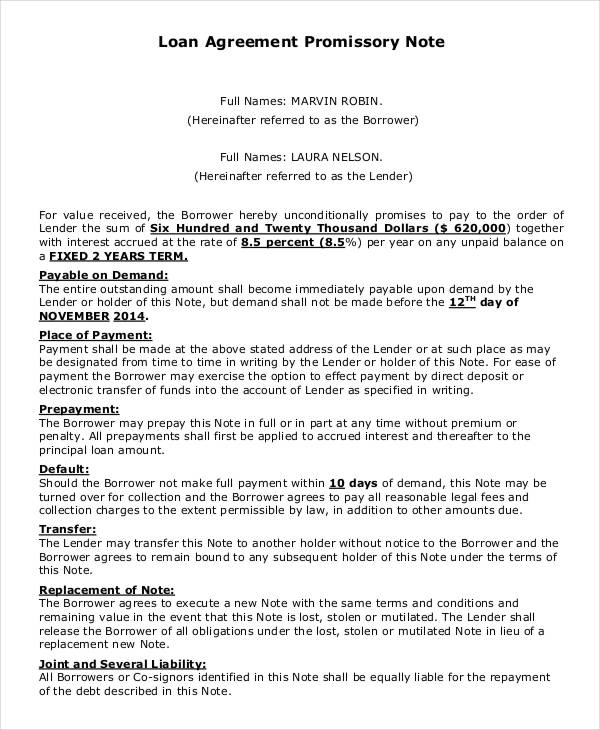

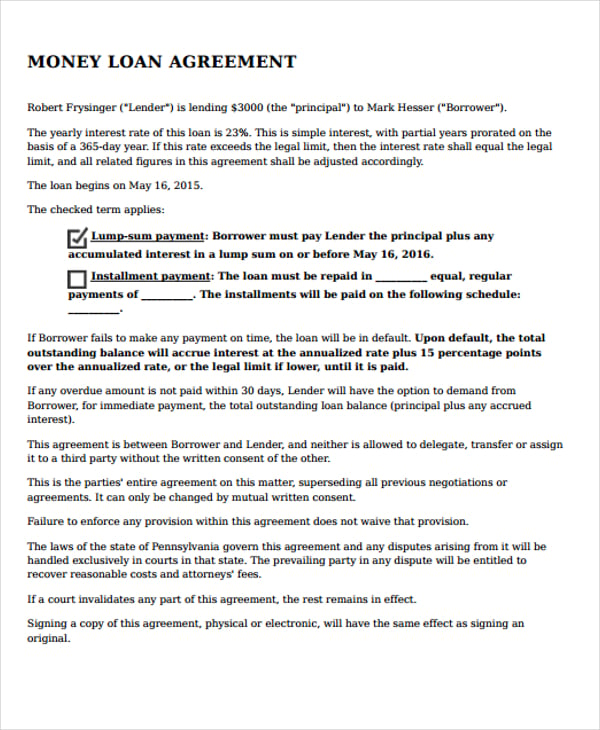

25 Sample Note Templates Pdf

Web Yes you can include the mortgage interest and property taxes from both of your homes.

:max_bytes(150000):strip_icc()/closed-end-line-of-credit-5225175-final-68ac58d3b05e40e29ce8b68d354960a8.png)

. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice. Sch A only submits one. Get a Great Return.

Web The limit drops even more to 375000 if youre married and filing a separate return. Fed Rate Hikes Mean Higher APYs on Bankrate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Loan Balance 5 Years. Ad COUNTRY Consistently Receives High Ratings For Financial Strength and Client Satisfaction. Web 2 days agoThe 30-year fixed rate mortgage has run north of 6 all year.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. A married couple purchase a home and obtain a mortgage in the amount of 200000 with a 10-year term of equal monthly payments and a fixed 4. However the deduction for mortgage interest starts to be limited at either.

Web The Tax Cuts and Jobs Act TCJA of 2017 reduced the maximum mortgage principal eligible for the interest deduction to 750000 from 1 million. Take Advantage And Lock In A Great Rate. Great News for Savers.

Mortgages taken out before October 13 1987 also known as. This new law only applies to homes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

7 Lets say you borrowed 1 million against your primary residence in 2022. Web Example 1. Great Home Insurance Protection and Valuable Discounts.

For the week ending March 16 it averaged 660 down from 673 the week before. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. Web 1 day agoThe entirety of the mortgage interest can be deducted if it fits into at least one of this three categories.

Choose The Loan That Suits You. Web Interest on pre-TCJA mortgages totaling up to 1 million 500000 for single taxpayers or married taxpayers who file separately plus interest on home equity. Web 2 days agoEven 1 percentage point in interest can make a big difference over the course of a 30-year mortgage.

Monthly Principal Interest. Paying 6 rather than 7 on a conventional 500000 loan for. A year ago the.

Ad See how much house you can afford. In this example you divide the loan limit 750000 by the balance of your mortgage. Ad Bankrate is The Leading Personal Finance Destination for Rates Tools Advice.

Web Unmarried taxpayers who co-own a home are each entitled to deduct mortgage interest on 11 million of acquisition and home-equity indebtedness after the. Get a Great Return. Interest Rate APR 3528.

Web Mortgage Type 25-YR FRM 30-YR FRM. It looks like you have followed Table 1 Worksheet to Figure Your Deductible Mortgage Interest - please double check before entering. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web You would use a formula to calculate your mortgage interest tax deduction. Ad Get All The Info You Need To Choose a Mortgage Loan. Use NerdWallet Reviews To Research Lenders.

Get both from COUNTRY Financial. Great News for Savers. Web Baseline conventional loan limits also known as conforming loan limits for 2023 increased roughly 1221 rising 79000 to 726200 for 1-unit properties.

Web The Excess Mortgage worksheet in the Individual module of Lacerte is based off the IRS Worksheet To Figure Your Qualified Loan Limit and Deductible Home. Web Under the new tax law homeowners can only deduct mortgage interest paid on up to 750000 on a first or second home. Web One point typically is 1 of the mortgage amount and lowers the interest rate by 025 though point costs and interest rate reductions vary by lender.

Fed Rate Hikes Mean Higher APYs on Bankrate.

Texas Home Buying What Are Mortgage Points And Should You Buy Them

Which States Benefit Most From The Home Mortgage Interest Deduction

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

The Tcja S Cap On Mortgage Interest Deductions Tells Us That Taxes Matter Up To A Point Tax Policy Center

Top Fixed Rate Home Loans March 2023 Mozo

:max_bytes(150000):strip_icc()/moores-law-4192714-1-5432709ba34c4a86bc7356f5274946ee.jpg)

What Is Moore S Law And Is It Still True

25 Loan Agreement Form Templates Word Pdf Pages

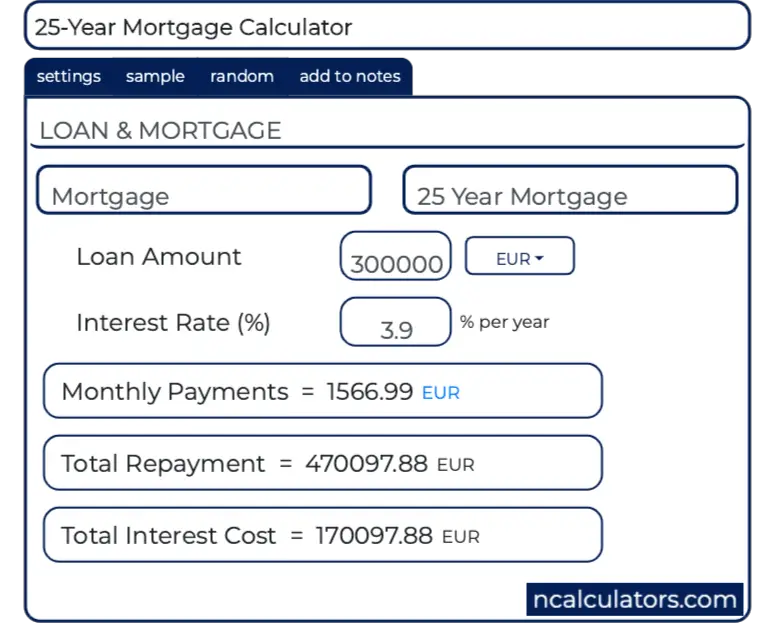

25 Year Mortgage Calculator

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

25th Anniversary Of Hfm Nederlands Film Festival

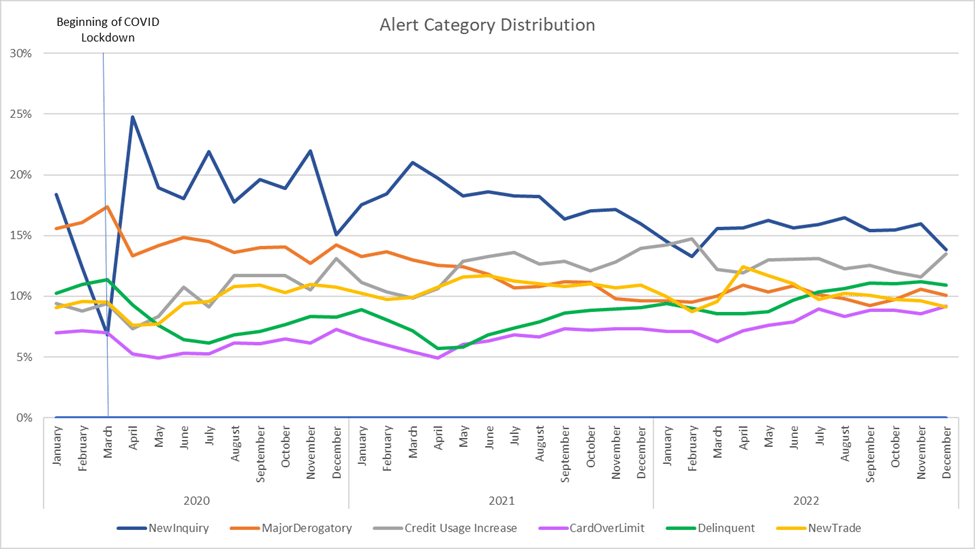

Scoresense Market Report Review Of 2022 Credit Activity Post Holiday Spending Survey Scoresense

Lower Mortgage Rates No Relief For Us Home Sales Wolf Street

Markets In A Minute What S Next For The Housing Market

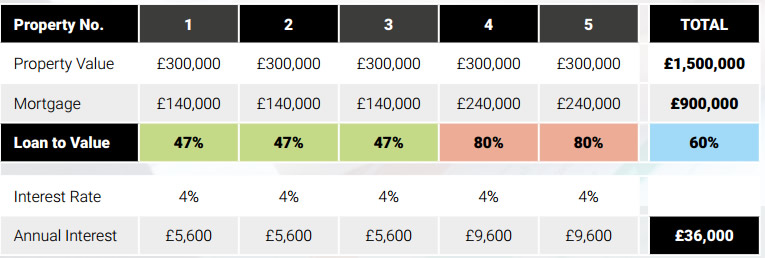

Strategic Re Mortgaging To Mitigate Section 24 Mortgage Interest Relief Restrictions Fylde Tax Accountants

Home Loan Interest Rates In Australia Compare Mortgage Rates Mozo

Interoperability Insights From Down Under Healthcare In Europe Com

Finance Me